Is the Tail Wagging the Dog at Your Institution?

By:

Jill A. Pursell

In nearly every process improvement engagement conducted by TKG, we find a tail wagging the dog. This occurs when either the sales or operational side of the bank dominate, take, or have control. It is largely the result of where the power lies within an organization below the President and CEO.

The Sales Side

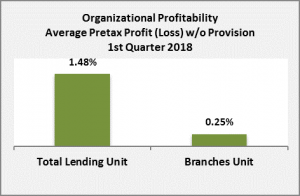

In TKG’s experience, when the power of control exists on the sales side, it is typically in commercial and/or residential lending, and rarely found in retail banking. This is a bit odd when you think of the face time branch employees have with customers. This is because the lending units are key drivers of revenue. According to TKG’s Profitability Measurement Peer Group Analysis for the first quarter 2018, the lending units produced the highest pretax profit (without loan loss provision) as compared to the branches as shown in the graph at right. Commercial mortgages deliver the highest pre-tax profit margin at 2.09%, followed by commercial construction loan products at 1.31%, and commercial lines of credit at 1.24%.

Because commercial lending plays such an integral role in a bank’s performance, commercial lenders are typically paid higher base salaries and receive additional incentive compensation for achieving their goals. Because of their contribution to the bank’s performance they are often referred to as “rain makers”. Their success, at times, can result in outsized influence. When this occurs, commercial lenders rarely give consideration to the workflow or other operational aspects of loans-in-process unless bottlenecks occur preventing them from getting loans closed. Lenders with outsized influence are known for scheduling loan closings before necessary documents have been ordered and received, which then results in fire drills in back office operations and credit administration. It is also common for these individuals or top producers to think their deals take priority over other loans-in-process and will make reference that the loan is for a “VIP” and should take precedence. In larger institutions with a high number of lenders, you can only imagine the challenges this causes in credit administration and loan operational functions, particularly at the end of a quarter or year.

In addition, when it comes to technology, many lenders are less inclined to use it. This is particularly the case when it comes to entering data into a customer relationship management system (“CRM”), an investment that often comes with a hefty price tag. In TKG’s experience, commercial lenders use of CRMs falls into one of the following three categories:

- Ignore the system exists and don’t use it.

- Enter only the amount of information required by management.

- Delegate the task of entering data to someone else.

It is unusual yet refreshing when a bank has commercial lenders who recognize the importance and embrace the use of CRMs. When it comes to using loan origination systems, lenders understand the value these systems provide, especially when it comes to having the ability to monitor the status of loans-in-process. However, many top producers aren’t required to use this system and have assistants to help with administrative duties.

The Operations Side

When outsized influence resides in operations, it is typically driven by “drill sergeants” within these areas. These employees have strong personalities and like to impose their will in the oversight of processes and procedures. They perceive themselves as the protector of the bank with a primary focus on following procedures, safety and soundness, regulatory compliance, and making no mistakes. Their tolerance for risk is low and usually does not align with a bank’s appetite for risk. They believe errors are prohibited and to be avoided at all costs. Processes and procedures are established using a belts and suspenders approach and often times, controls in place are similar to those of a troubled institution. Drill sergeants are reluctant to change legacy processes and procedures unless it is to instill further monitoring and control.

When a financial institution has drill sergeants, we often hear comments from operation employees such as “The branch employees make too many mistakes requiring me to double check their work.” or “The answer they need is in their procedures and they shouldn’t be calling us with simple questions.” From branch employees we hear “Every time I call with a question, employees in operations are so rude.” or “Operations has no clue what it is like to have customer in front of them waiting for an answer.” From the lending perspective, we often hear from operational employees, “The lender needs to provide me all documents before I will process their request.” and from lenders we hear “Operations doesn’t understand how important it is to provide a quick turnaround to compete in the market place.”

In many instances, financial institutions create their own drill sergeants. How? Management turns over special projects to them because of their deep operational knowledge, knowing they can get the job done. This can give them the perception of outsized influence.

When it comes to technology, drill sergeants are usually open to upgrading technology or making investments in new software applications. This is especially so when it addresses a regulatory need or requirement. However, many fail when it comes to the selection and utilization of technology. TKG has observed managers who customize systems to match current processes and workflows instead of using the software for how it was designed. There are others who implement technology and fail to recognize operational and resource efficiencies. But the biggest issue we see relates to financial institutions that make significant investments in purchasing core and ancillary technologies and only utilize 30-40 percent of the system’s capabilities. This is similar to a consumer who buys a loaded luxury vehicle and only uses a few of the options even after owning the car for several years.

What are the Consequences of all of this?

One of the ways dominant behavior is often observed is through the use of what TKG calls “nasty grams”, or offensive emails which belittle and berate employees for not following procedures. Senders of these messages use their power and influence to demand action often cc’ing managers and/or executives. Are you experiencing this behavior in your institution?

Are you seeing any other repercussions from the tail wagging the dog in your institution? Here are some side effects of this behavior that can negatively impact your institution.

- Operating Costs – Inefficient processes and procedures and utilization of technology resulting in higher operating costs.

- Growth Strategy – When employees are unable to work together in a collaborative manner this often results in difficulties in executing a bank’s growth strategy.

- Customer Experience – Many community banks believe the high touch/personal experience they provide their customers allows them to differentiate themselves from the competition. Allowing any one area to have an outsized influence can lead to a negative customer experience.

- Employee Experience – The level of frustration and contention may result in employee turnover and loss of key high performing employees.

Sometimes executives are unaware this behavior is occurring and other times it is known. What is not clear is how it can prevent the institution from successfully executing their strategy. Is the tail wagging the dog at your institution and preventing you from improving operational efficiencies and maximizing profits?

In order to correct this behavior, you need to identify where it is occurring and through strong leadership break down and remove these barriers and build a collaborative culture. Doing so will allow you to achieve best in class financial performance and customer experience.

Click here to view printer-friendly version