Sometimes High, Sometimes Low, Easy Come and Easy Go

Who would have thought that a 1990 Winger song would be the headline for TKG Perspective?

However, 2018 is one for the record books in the world of cryptocurrencies. As of September 12, 2018, the MVIS CryptoCompare Digital Assets 10 Index, a modified market cap-weighted index which tracks the performance of the 10 largest and most liquid digital assets, was down 79.8% from the high posted on January 7, 2018. The gains in cryptocurrencies have been easy come, easy go.

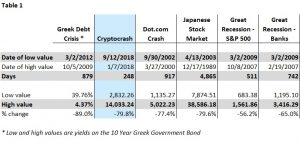

I still am trying to figure out what a cryptocurrency really is and its long-term value proposition. Before we try to do that, just how bad is the 79.8% decline in the annals of finance? Table 1 helps frame the Cryptocrash relative to some other notable price declines.

The Cryptocrash is notable for several reasons. First is the swiftness of the decline in value, less than nine months. The Cryptocrash is somewhat similar to the Greek Debt Crisis in that the decline is focused on a narrow asset class. Also, there is a technology-tie to the Dot.com Crash. Some experts argue that the run-up in prices for cryptocurrencies was all hype, or market manipulation. They may also say the decline in price is a sign that there are security flaws in the underlying technology or that widespread adoption is too far out into the future and, as a result, developer interest has plummeted with the prices. The August 2018 action by the U.S. Securities and Exchange Commission to deny approval of a number of cryptocurrency exchange traded funds has not helped in maintaining confidence in this currency.

Nonetheless, this article is not going to play compare and contrast among the collapses, nor are we going to try to find something worse than the collapses outlined in Table 1. Instead this TKG Perspective is going to articulate far bigger concepts than the Cryptocrash. The real issue at hand: will the decline in the price of cryptocurrencies act as a deterrent to the advancement and adoption of the underlying blockchain or similar technologies?

In the 2008 whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System”, the first sentence of the abstract is “A purely peer-to-person version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”. Yikes – that does not sound good for the banking system, and perhaps Sovereign nations if they lose control of the payment system and their individual and interconnected currencies!

What is Blockchain Anyway?

Blockchain technology is at the core of the cryptocurrency evolution, with blockchain’s origins being traced to the early 1990s. As time progresses, there is less and less consensus on the definition of “blockchain” and what it really is. Generically speaking, a blockchain is a cryptographically enhanced shared public ledger which can be used to track ownership of assets. It is a peer-to-peer network. Many blockchains do not have anything to do with a cryptocurrency but rather can track items such as contracts, real estate ownership, shipping containers, loans against property, and oil tankers. Many blockchains are not in the public domain and instead are private. In addition, there isn’t one blockchain but a lot of variations on blockchains. Most blockchains do not even connect to one another. But there really is not a universal definition of blockchain.

Blockchain’s Competition

New technologies, or at least new approaches, that may surpass or overcome some of blockchain’s shortcomings (such as the amount of computing power required to add a blockchain ledger) are emerging. One of those technologies is being developed by the IOTA Foundation, a German nonprofit and is based on decentralized data marketplace. IOTA is a cryptocurrency that is not based on blockchain’s “mining” distributed consensus system of confirming pending transactions. When a transaction is “mined” for a Bitcoin transaction, verification usually takes 10 to 20 minutes to complete. Mining is a bit competitive too, as miners get paid.

Instead, IOTA uses a “tangle”, which is based on a mathematical concept called a “directed acyclic graph”. In a tangle, when a new user initiates a transaction, that individual also validates two previous transactions, each of which refer to two other transactions and so on – as the new transactions increase, a “tangled web of confirmation” grows. I am far more simplistic – I think of the early 1980s commercial for Faberge Organic Shampoo starring Heather Locklear – where she tells two friends about how wonderful her hair looks, and then the two friends tell two friends and so on and so on and so on. A tangle is free and takes only seconds to complete. And the simplicity means less processing power and the ability to apply the approach to the Internet of things, not just on computers.

All Systems Go

The downturn in the price of cryptocurrencies is far more painful to those who bet on the technology as an investment vehicle. A cryptocurrency is a medium of exchange, has no physical form, has no intrinsic value, cannot be redeemed for another asset and in the case of Bitcoin, has a fixed supply (set at 21 million Bitcoin – enough to last until the year 2140). The total value of all cryptocurrencies as of September 29, 2018 is around $250 billion, down from nearly $1 trillion earlier in 2018. By a means of comparison, the run up in the value of the Nasdaq index and subsequent fall through the Dot.com Crash wiped out trillions of dollars of value.

The origin of the internet can be traced back nearly 50 years. I can trace it a bit differently. My business card in 1997 did not have an email address though I had a personal AOL (American Online) account. Dot.com mania struck in early 2000 and Dot.com led initial public offerings around that time. So, in my simplistic approach, Dot.com mania took hold maybe five or six years after the Internet went mainstream. Blockchain took a bit longer to really take hold from the underpinnings in 1991 until now, though the window from concept to mainstream was shorter than the development of the Internet.

The Dot.com Crash re-focused capital onto business models that were sustainable. In many respects the Dot.com Crash cleaned up how the Internet was going to be used for commerce. Without getting overly personal here, I have experience when it comes to betting on new technologies: my worst bet – Webvan. Webvan was going to allow customers to place grocery orders online and presto, groceries would be delivered to your home. Great idea on paper, but I always wondered how they could control distribution and do so efficiently. They could not deliver (literally and figuratively) and Webvan went from startup, to darling, to kaput in about three years. In its place today is Amazon and many delivery services from regional chains – they solved the distribution dilemma.

The downturn in the price of cryptocurrencies will not stop the advancement of blockchain and other technologies. Though it will make development more efficient and more competitive. One of the institutions at the forefront of open source, distributed ledger and smart contract platform is none other than JP Morgan and their QuoromTM software, developed through their Blockchain Center of Excellence. Another is Goldman Sachs, which is backing “Circle”. The point is, there is big, sophisticated money working on these technologies in an attempt to take distributed ledger concepts mainstream – a distributed ledger 2.0. The promise of these developments – bedsides cryptocurrencies – is a far more efficient means to perform loan accounting and manage contracts than the processes existing today.

For the banking industry, the larger institutions will lead the way. At this point there does not appear to be consensus as to the “best” approach. Nor is there convergence to tie all approaches into one centralized distributed ledger. Perhaps someday. Other institutions will be forced to follow or simply choose not to participate at their own peril. But there is no stopping the advancement of these technologies and their impact on the banking industry, in terms of financial performance, efficiency and structure. It’s only a matter of when, not if.