Is Loyalty Worth It?

What is the value of a loyal customer? And what is the difference between a transactional customer and a loyal one? This was the subject of the keynote speaker, James Kane, at the recent Financial Managers’ Society FMS Forum in Boston.

When you talk about loyalty to financial institution CFOs and Controllers, as Kane did at the FMS Forum, they’re likely not thinking about the stuff in a typical TV commercial, such as having an engaging conversation or meeting at the coffee shop. No, I think they are likely thinking “what is the cost of earning loyalty”, “what additional revenue will I get for the cost”, or “will that increase duration in my ALCO model”?

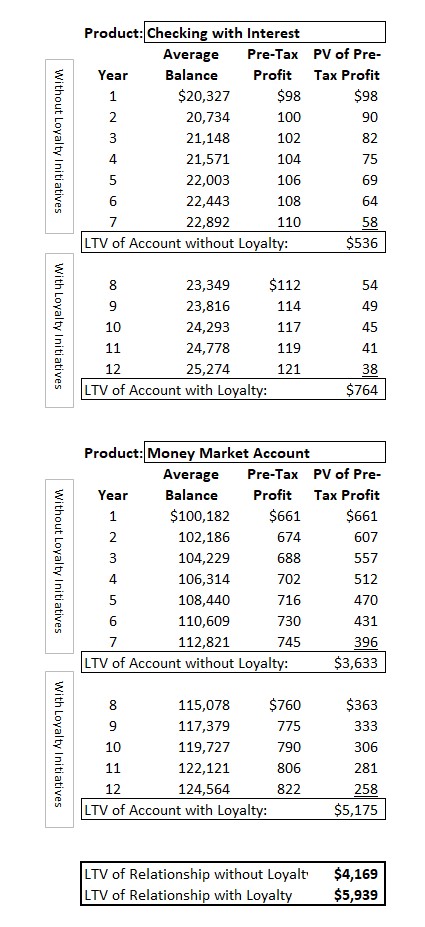

Back to the question, what is the value of a loyal customer? Assuming loyalty would extend the life of a customer relationship at your financial institution, we can calculate the Lifetime Value (LTV) of a loyal customer versus a transactional customer. LTV is the present value of the total profit delivered by a customer over their lifetime with your institution. So before you dedicate organizational resources to extending the duration of a customer, we should first answer: Is it worth it? And if so, what is the incremental cost to achieve loyalty?

The accompanying tables compare the LTV of an account with and without loyalty. The assumption is that a core deposit customer, in this case a retail customer with a checking and money market account, would extend their time with your institution from seven to twelve years, if they were loyal to you. Seven years would be the assumption if they were a transactional customer… i.e. they are indifferent to you. Inertia keeps them there. So long as you don’t awaken them from their slumber.

I’ve also assumed a 2% growth rate in average balances, and a 10% discount rate.

The tables assume the pre-tax profit as a percent of balances from The Kafafian Group’s first quarter 2019 product profitability database. One might argue that loyalty would lead to more products and services. But for the sake of simplicity, let’s assume that the journey from a transactional to a loyal customer extends their stay with your institution from seven to twelve years.

The tables assume the pre-tax profit as a percent of balances from The Kafafian Group’s first quarter 2019 product profitability database. One might argue that loyalty would lead to more products and services. But for the sake of simplicity, let’s assume that the journey from a transactional to a loyal customer extends their stay with your institution from seven to twelve years.

You have to determine if the $1,769 difference between each LTV is worth the effort to win their loyalty. What would it take, in terms of resources?

Kane had ideas on what it would take, in human terms, to move customers from transactional to loyal. He formed three questions for you to answer:

1. Do you make your customer safer?

2. Do you make your customer’s life easier?

3. Do you make their life better?

He went further to give context when asking those questions and setting out to turn each into a resounding “yes”. The brain, as Kane told it, is looking for three things:

1. A sense of trust.

2. A sense of belonging.

3. A sense of purpose.

This is beginning to feel a lot like Maslow’s hierarchy of needs. Thanks to the Internet, I don’t have to dig into the psychology section of my college text books to find an illustration of the hierarchy. And for clarification, all sections of my college text books are in one moldy box in the basement.

As I study the three questions, and what the human brain yearns for, I don’t see much in terms of incremental cost to achieve them. Deposit insurance and the safety of your financial institution protect your customer’s money, i.e. makes the customer “safer”. Or this need could be more existential, such as will this money grow to provide the physiological and safety needs in Maslow’s hierarchy throughout the customer’s lifetime?

As I study the three questions, and what the human brain yearns for, I don’t see much in terms of incremental cost to achieve them. Deposit insurance and the safety of your financial institution protect your customer’s money, i.e. makes the customer “safer”. Or this need could be more existential, such as will this money grow to provide the physiological and safety needs in Maslow’s hierarchy throughout the customer’s lifetime?

Looking at this existentially would require a wholistic, and relational context to how your financial institution treats customers. Or do you treat them as transactional customers? Luring more of their money with a rate promotion that you intend to lower once the promotional period runs out. That would be contrary to the “sense of trust”, wouldn’t it?

Making the customer’s life “easier” would seem to be about product design, technology, and internal processes. If your culture asks with every process, “does this make our customer’s life easier?”, how many processes would be re-designed or eliminated? Putting the customer at the forefront of this question instead of putting the Compliance Officer, the Auditor, or the regulator is a critical ingredient to customer loyalty. Don’t ignore those three. But they don’t have to come first, either.

Making a customer’s life “better” could be the single biggest differentiator of a community financial institution from a large bank or fintech. This requires an interpersonal relationship between banker and customer. Creating a “sense of belonging”. Perhaps, in the future, you can meet this need through a piece of software or a robot. But I think this is far off into the future, if ever. No, your people are best suited, now and into the future, to help customers lead better lives. Are you creating the environment, career pathing, and development plans to increase the pool of employees that will be able to deliver ?

As I mentioned, I don’t think significant financial resources are needed to increase customer loyalty. What is required, however, may be a change in your financial institution’s culture. Because as long as you treat your customers as transactional, how can you build the loyalty your customers so want to give you?

Click here to view printer-friendly version.

This newsletter relates to our Strategic Management service, click here for more information.

To receive our newsletter and other TKG content, subscribe at the bottom of this page.