Conscious Banking

I was once that guy who pulled into a Whole Foods Market parking lot, parked next to a Prius, revved my Camaro, and smiled. I hope I evolved since then. At least my stereotype about the grocer was wrong. Its co-founder, John Mackey, is a libertarian who believes corporations should serve a higher purpose. It’s the basis behind his 2014 book, Conscious Capitalism.

I never knew of Mackey or his book until he was a guest on a Freakonomics podcast. Freakonomics is my second favorite podcast, my favorite being The Kafafian Group’s This Month in Banking. When he spoke of corporations unleashing their potential and serving all their constituencies equally well, it resonated with me. If corporations are considered a person in the eyes of the law, shouldn’t we be a good one?

According to New York State Business Corporation Law (“BCL”): A corporate director, in taking action, including, without limitation, action which may involve or relate to a change or potential change in the control of the corporation, a director shall be entitled to consider, without limitation, (1) both the long-term and the short-term interests of the corporation and its shareholders and (2) the effects that the corporation’s actions may have in the short-term or in the long-term upon any of the following: (i) the prospects for potential growth, development, productivity and profitability of the corporation; (ii) the corporation’s current employees; (iii) the corporation’s retired employees and other beneficiaries receiving benefit from the corporation; (iv) the corporation’s customers and creditors; and (v) the ability of the corporation to provide, as a going concern, goods, services, employment opportunities and employment benefits and otherwise contribute to the communities in which it does business.

New York is not unique in its BCL. Most states’ BCLs read similarly and rank employees, customers, and community on par with shareholders. But there are dogmatic adherents to the philosophy so convincingly made by Milton Friedman in his 1970 New York Times essay, The Social Responsibility of Business Is to Increase Its Profits. The BCL and Friedman are seemingly at odds, pitting shareholder primacy versus stakeholder primacy.

Or are they? In 2019, the Business Roundtable issued the Statement on the Purpose of a Corporation, signed by 181 members, that ended “Each of our stakeholders is essential. We commit to deliver value to all of them, for the future success of our companies, our communities and our country.” In Conscious Capitalism, Mackey, and his co-author Raj Sisodia included an entire appendix of conscious companies that delivered stellar financial returns.

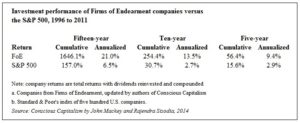

The appendix was based on Sisodia’s 2014 book, Firms of Endearment, where he and his co-authors selected companies on the basis of their so-called humanistic profiles (their sense of purpose; how well they were loved by the customers, team members, suppliers, and communities; their cultures; and their leadership), not their financial performance. The only financial criteria was that the business had to be a going concern. Their performance compared to the S&P 500 is in the table below.

OP Bancorp (Nasdaq: OPBK) in Los Angeles is focused on serving the banking needs of small- and medium-sized businesses, professionals, and residents with a particular emphasis on Korean and other ethnic minority communities. Its vision is to be known as a faith-based community bank focused on relationship banking. It gives 10% of its pre-tax profit to the Open Stewardship Foundation, whose objectives are to actively support local civic, Christian, and public service organizations and schools that advance education, help the needy, provide medical services, feed the hungry, or offer other charitable or public benefit services. OP delivered a 1.51% ROA and a 12.42% ROE in 2019.

Being a Firm of Endearment did not appear to impact their financial performance. In fact, it might have improved it.

Corporations should consider a higher purpose because people (i.e., our employees and customers) need a higher purpose. According to a 2019 survey of over 1,000 people, Washington University of St. Louis researchers found that employees at companies with a statement of higher purpose are happier, prouder of their company and have greater trust in its leaders. Researchers went on to say “We as human beings need and want to know that our lives have purpose and meaning—both as individuals and as contributing members of the work organizations where we spend a significant portion of our lives.”

If your greatest assets go up and down your elevators every day (or are now working from home), would they be happy delivering solely to shareholders? Especially if there is ample evidence that focusing on a higher purpose that informs all decision-making can be part of a strategy to inspire and motivate all employees, increase retention, and improve profits.

If employees want to work for a company with a higher purpose, it stands to reason that customers will want to be part of it too. In a commoditized industry, where we can barely distinguish one bank’s products from another’s, serving a higher purpose can certainly be your differentiated elevator pitch.

Strategy involves exploring some fundamental questions. Why are we in this business? What value can we bring? What role does my bank play in improving the plight of customers, employees, shareholders, and communities? Purpose creates a basis for answering those questions. This focus on collective objectives, in turn, opens many more opportunities to distinguish ourselves from the competition, and improve growth and profitability today and in the future.

What’s your institution’s higher purpose?

Click here to view a printer-friendly version.

This newsletter relates to our Strategic Management service, click here for more information.

To receive our newsletter and other TKG content, subscribe at the bottom of this page.