Strategic Alignment: Accountabilities

Accountability gets a bad rap. You can see people wince and hear the hushed tones when speaking about it. It’s not comfortable being “accountable” for a metric, a deadline, or a result. To us, it is evidence of the financial institution’s culture or the quality of leadership.

So often accountability equates to difficult conversations, calling out those that miss targets in meetings, or negative marks in our performance reviews. Must accountability be so negative?

Not if it is engrained in your culture, implemented by experienced and well-trained managers, and celebrated with the tone at the top. Yes, celebrated.

Because the way we view accountability, if invoked at all, is through negativity. We don’t celebrate those who achieve or exceed results nearly as much as we chastise those who miss the mark. This enables a culture of fear when people are called into the boss’s office or receive their performance reviews. It’s not very inspirational.

And it’s not very effective, if by effective we mean to maximize employees’ abilities. It doesn’t have to be that way. Well trained managers know that authentic praise goes a long way in building cultures of positive accountability where people welcome rather than fear feedback. A culture where people want to work. One where all are accountable from the boardroom to the teller line, and accountabilities are consistent with strategy.

Strategic Alignment

Truth be told, achieving this culture has been a challenge. First, accountability tends to lead to recrimination more than back slaps. Could this be because those in leadership roles never were formally taught how to get the best from those that work for them? The best loan servicer doesn’t necessarily make the best AVP of Loan Servicing. Have we given that person the tools to succeed at her job so much so that those who work for her are more likely than not to excel? We discuss this issue in our September 2022 podcast episode, This Month in Banking, Banks are Responsible for Building Bankers!

Second, accountability is not typically universally applied. We hold branch managers accountable for sales goals, and lenders accountable for volumes. But do we hold deposit operations accountable for positive trends in number of accounts per full-time equivalent (FTE) employees or department operating expenses as a percent of deposits? Why do so many branch personnel transfer to the back office? One common theme we hear is that branch people are much more accountable than support functions.

Thirdly, our accountabilities are not often tied to our strategy. If a key performance indicator (KPI) for our institution’s strategy is Return on Assets, does that permeate throughout the organization? Sure, it is likely part of our executive compensation plan. Tying exec comp to strategic priorities is fairly common. But does it bleed throughout the institution?

Strategic Alignment at Work

How would this work? We have opinions.

How would the ROA strategic priority make its way throughout the organization? As mentioned, it should obviously be part of executive compensation schemes. And in this regard, we see financial institutions doing well.

It’s below the executive level that we see breaks in strategic alignment. One example we often cite is incenting lenders on volume. The easiest way to get volume is by price. How often do we hear “this is what we need to do to get the deal done” in loan committee? The second way to get volume is loose covenants. No personal guarantee? Doesn’t impact the lender’s volume goal.

Why not hold the lender, in part, accountable for the continuous profit improvement in his or her loan portfolio? In other words, the pre-tax profit as a percent of their portfolio, i.e. ROA. Now it aligns with the KPI in the strategic plan. Mind, blown.

This makes so much sense, it’s a wonder that we see so few financial institutions doing it. We have at least one theory why something that makes so much sense isn’t part of the accountability culture. Financial institutions typically don’t measure lender portfolio profitability. So they come up with some other scheme that they can measure, that is often contrary to the corporate KPI.

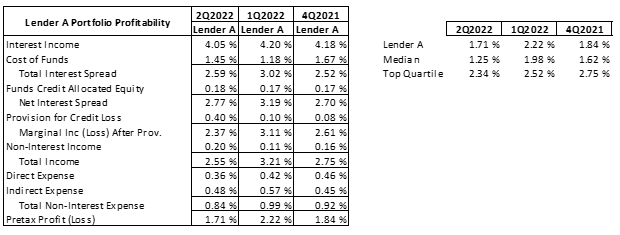

The above chart demonstrates where a particular lender’s pre-tax profit as a percent of his or her portfolio stands compared to all lenders, and the top quartile lenders. This is motivation. Imagine a chart with average portfolio profitability trends and top quartile profitability trends prominently posted in the commercial lending department with a list of the top quartile lenders. A report that is sent to the CEO. And the CEO calls every one of those listed to congratulate them on their performance.

Now do something similar for the branch. Where does a particular branch rank in pre-tax profit as a percent of its deposits? And how does that stand with the all-branch average, and top quartile branches. The bonus pool could be much more lucrative for the top quartile versus the bottom. Instead, we see branches held accountable for account open-close ratios or aggregate deposit balances. The best way to grow deposits is by price, right? Ever get those comments “if you want me to grow deposits, give me a rate.” That could easily serve to work against the corporate ROA KPI.

So why not hold branches accountable for the continuous profit improvement of their branch? Hold awards ceremonies or pizza parties for the most improved, etc. Execute accountabilities in a positive manner. This doesn’t mean that you ignore the bottom performers. In a positive accountability culture, the regional manager or head of retail can sit side-by-side with each bottom quartile branch manager to devise a plan for improvement, educate them on the levers they can press to improve, use feedback loops from successful branches on what they do to drive performance, and mobilize bank wide resources to help that branch improve.

Financial institutions do little of this in our experience. And the reason is that they don’t typically do branch profitability, or they think branch people won’t understand the reports even if the institution measured branch profitability (i.e. “nice to know” reports), or executives think them unnecessary because they already “know” where they do and don’t make a profit.

We heard that last reason recently from a bank CEO. And we would bet she was right. She probably knew the top and bottom quartile performers. And in a 20-branch system, she could probably correctly guess the top and bottom quartiles four out of five times by simply throwing grass in the air. But if the institution isn’t measuring it, then they certainly aren’t holding branches accountable for continuous profit improvement. The grass in the air simply isn’t enough. So it’s not going to be part of the culture. And if that institution has an ROA KPI, then it is likely not consistent with the branch accountability scheme.

Support centers should also be part of a consistent and positive accountability culture. We already remarked on the Deposit Operations Department. Similarly, loan servicing could be accountable for their operating expense as a percent of loans outstanding, and/or number of loans serviced per loan servicing FTE. The continuous drum beating for more resources might take a different turn, where the AVP of Loan Servicing might request a new system or new FTEs in her budget, which would slightly elevate her operating expense/average loans in the short-term, with the goal of lowering it long-term. How refreshing!

This all may seem self-serving because we provide financial institutions with this information on an outsourced basis. And in that regard, it is. But when we enlisted the assistance of a financial marketing firm to get our message out, we told them that all financial institutions should do this, whether they did it with us or not. And the truth is, many, if not most, don’t do it at all.

In a changing and consolidating industry, financial institutions that want to remain independent have to align strategy with what goes on at the institution every day, including your accountabilities and the culture you create to maximize performance. Do your accountabilities match your strategy?

Click here to view printer-friendly version.

This newsletter relates to our Strategic Management service, click here for more information.

To receive our newsletter and other TKG content, subscribe at the bottom of this page.