Branch vs. Lending Organizations: Which Organization Won the 2020 Profitability Battle?

Community financial institutions came off of a strong year in 2019 and entered 2020 a little apprehensive. The economy was slowing, the Fed started lowering interest rates and there was a presidential election on the horizon. By the middle of the first quarter of 2020, apprehension turned into anxiety. Today we are not completely over our high level of anxiety about future performance, but we did end 2020 with solid earnings (Community Banks ROE of 9.74% in 2020) led by the mortgage re-fi boom and PPP loan related income. The Q4 2020 PEER data from our Performance Management clients provides some interesting information about 2020 community financial institution performance.

A look at the financial results of the branch and lending organizations within a community financial institution shows how low interest rates in 2020 impacted each of them.

Deposits at community banks grew 18.3% last year, but this increase in deposits did not help the profitability of branches as noted by the reduction in the Q4 2020 “return on deposits” to 0.08% at our PEER group branches.

What is the true value of branch deposits in this current low interest rate environment? Through our Performance Measurement services we provide institutions with branch profitability reports including the “net deposit spread.” Since a branch would only have interest expense on deposits, we calculate a “credit for funds” for deposits to provide interest income and a net deposit spread for a branch. The credit for funds is based on the average life of an institutions’ deposit products. Since the average life of a core deposit is higher than a 1-year CD, the core deposit has a higher credit for funds and is thus more valuable for a branch. We use the FHLB Fixed-Rate Advance curve to calculate the credit for funds.

In a rising interest rate environment, the value of deposits increases since institutions do not need to increase their rates at the same level as FHLB borrowings rates and other market rates. As interest rates decline, the opposite is true. While banks have lowered their deposit interest rates during the past year, they cannot lower them below 0.00%. The value of core deposits cannot be overstated. Even though core deposits may not be as profitable due to the current interest rate environment, they are the life blood of any financial institution and should always be coveted.

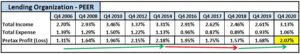

Looking at the Q2 2006 branch profitability, which is prior to the Great Recession, our PEER data shows the average branch made a pretax return on deposits of 1.09%. But as noted on the total income line, the drop in the net deposit spread was the driving force of the decrease in profitability to the -0.14% return on deposits in Q4 2014. The Fed dropped the Fed Funds Rate 500 basis points, but banks were limited in how low they could reduce deposit rates. Once interest rates began to rise in 2015, the profitability of branches began to grow reaching a peak profitability in Q4 2018. As the Fed began to lower rates during 2019, we see once again the net deposit spread and pretax profit began to decrease.

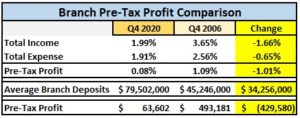

Comparing branch profitability in Q4 2020 and Q4 2006 illustrates how the profitability of branches has changed during this period. Total income as a % of deposits decreased by 166 basis points, primarily due to the decrease in the spread on deposits. While financial institutions decreased expenses by $0.65 per $100 of branch deposits, it was not enough to offset the reduction in deposit spread. Pre-Tax Profit per branch decreased $430,000, from 2006 to 2020 even though ”Deposits per Branch” increased $34.3 million, or 76%!

While the branch and deposit side of the bank has been negatively impacted by the low interest rate environment, the lending side of the bank has benefited.

As a result of the increase in loan spreads, the lending organization realized stronger earnings from the end of 2006 through 2014 (w/o LLP). The Fed lowered interest rates 525 basis points, but institutions did not need to lower interest rates on new loans by that same level, thus increasing the spread on loans.

The increase in interest rates beginning in 2015 resulted in a decrease in net loan spreads, as institutions could not pass all of this 225 basis point increase on to their borrowers. The decrease in the Fed Funds Rate in 2019 and 2020 once again helped increase the net spread and overall profitability of the lending organizations.

The significant increase in the Q4 2020 lending organization profit was also the result of the growth in non-interest income related to the gains on the sale of mortgages in the secondary market, partially offset by an increase in expenses. PPP loans also contributed to the growth in lending organizations’ profitability during 2020. Our PEER group PPP loans earned a Pretax ROA of 3.88% in Q4 2020 and contributed 0.22% to their institutions overall ROA! The high PPP loan earnings in Q4 2020 are the result of the recognition of PPP loan fees as these loans were forgiven.

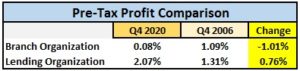

Comparing Q4 2006 and Q4 2020 performance, we can see how the changes in profitability of the branch organization (1.01% reduction in pre-tax return on deposits) and the loan organization (0.76% increase in pre-tax return on loans) has impacted the overall profitability of community financial institutions. Branches are negatively impacted by lower interest rates and lending organizations benefit from lower interest rates. But the increased profit in lending organizations could not fully offset the decrease in profits within branch organizations. The large reduction in branch profits during this period has impacted the overall profitability of commercial banks. The 5-year average ROA for commercial banks ending in 2006 was 1.31%, well ahead of the 1.11% in Q4 2020.

Comparing Q4 2006 and Q4 2020 performance, we can see how the changes in profitability of the branch organization (1.01% reduction in pre-tax return on deposits) and the loan organization (0.76% increase in pre-tax return on loans) has impacted the overall profitability of community financial institutions. Branches are negatively impacted by lower interest rates and lending organizations benefit from lower interest rates. But the increased profit in lending organizations could not fully offset the decrease in profits within branch organizations. The large reduction in branch profits during this period has impacted the overall profitability of commercial banks. The 5-year average ROA for commercial banks ending in 2006 was 1.31%, well ahead of the 1.11% in Q4 2020.

While the earnings outlook at the beginning of 2020 may not have been bright, community institutions ended up having a solid year primarily through the gain on sales of residential mortgages and the income generated from PPP loans. The level of residential mortgage originations will at some time revert back to normal levels, PPP loans will not last forever and the prospect of loan demand is mixed. With the continued pressures on the net interest margin and earnings, banks must focus on the reduction of costs and the branch network may provide the most opportunity for those reductions.

Our Performance Measurement service is designed to provide institutions with profitability information for their organizational profit centers and for the products they offer. Our clients also use data from these profitability systems to feed customer level data into their MCIF and CRM systems. Over the years we have provided this service to hundreds of institutions, so they can foster an accountability culture and improve their bottom-line results. One of the most valuable components of our service is compiling PEER information our clients can use to measure against their own performance.

Are you interested in learning more about how your bank can utilize performance measurement information to make more informed decisions to enhance the profitability of your organization and products? If so, please contact me at gwagner@kafafianstg.wpenginepowered.com or give me a call at 973.299.0300 ext. 114.

Click here for more information about our Performance Measurement service.