And Just Like That…

By:

Andrew S. Rietz

Since March of 2020, the near zero interest rate environment was a constant for bankers. For nearly twelve quarters running, the Federal Open Market Committee (“FOMC”) kept the target federal funds rate unchanged. And just like that, there has been a 25 basis point rate hike in Q1 2022, a 50 basis point rate hike in Q2 2022 (the largest rate hike since 2000), and another 75 basis point rate hike in June 2022. All in an effort to combat inflation. This was quickly followed up with another 75 basis point rate hike after the July 27-28th FOMC meeting as inflation reached 9.1% for the year ended June 2022, the largest increase in forty years. And just like that, bankers find themselves in a rapidly rising rate environment.

Securities Portfolio Shift

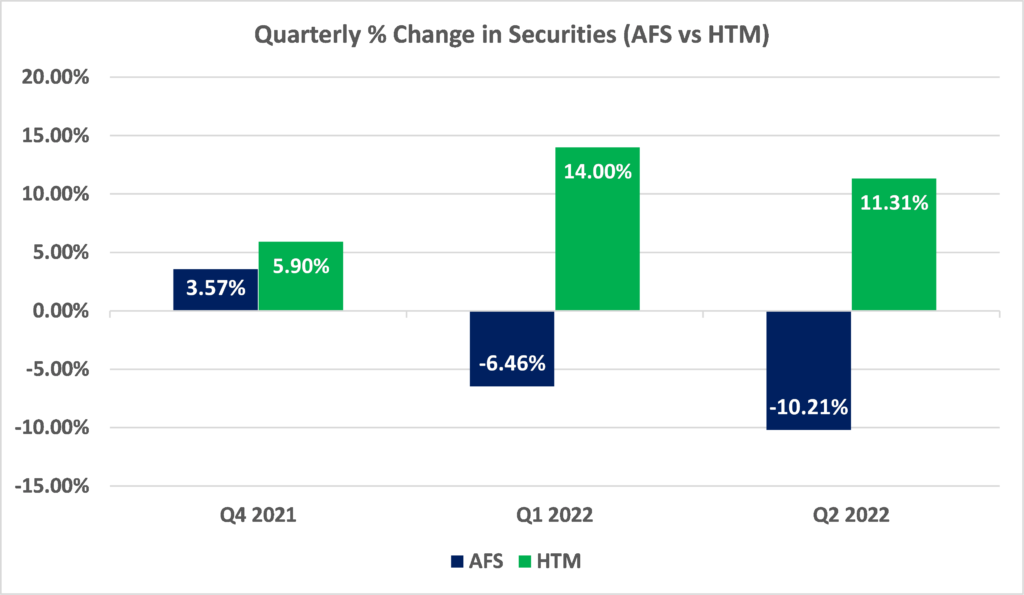

With record liquidity due to a myriad of factors, banks’ securities portfolios have grown exponentially. As of Q2 2020, held-to-maturity (“HTM”) and available-for-sale (“AFS”) securities as percentage of total assets was 13%. As of Q2 2022, that number is nearly 20%. The following chart shows the quarterly change in both HTM and AFS securities as interest rates began to rapidly rise in the first half of 2022. The decline in AFS securities from Q1 2022 to Q2 2022 of 10.21% represents a reduction of $488.6 billion. The 11.31% increase in HTM securities in Q2 2022 represents an increase of $273.2 billion.

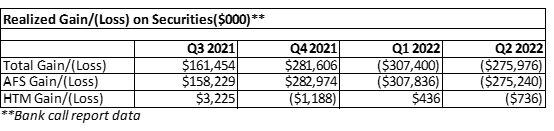

What has been the cost to banks as they have unloaded securities from their balance sheet? The following table outlines the cumulative realized gain/(loss) on securities from Q3 2021 to Q2 2022 for all U.S. banks.

Rate Hikes and Impact on Capital Ratios

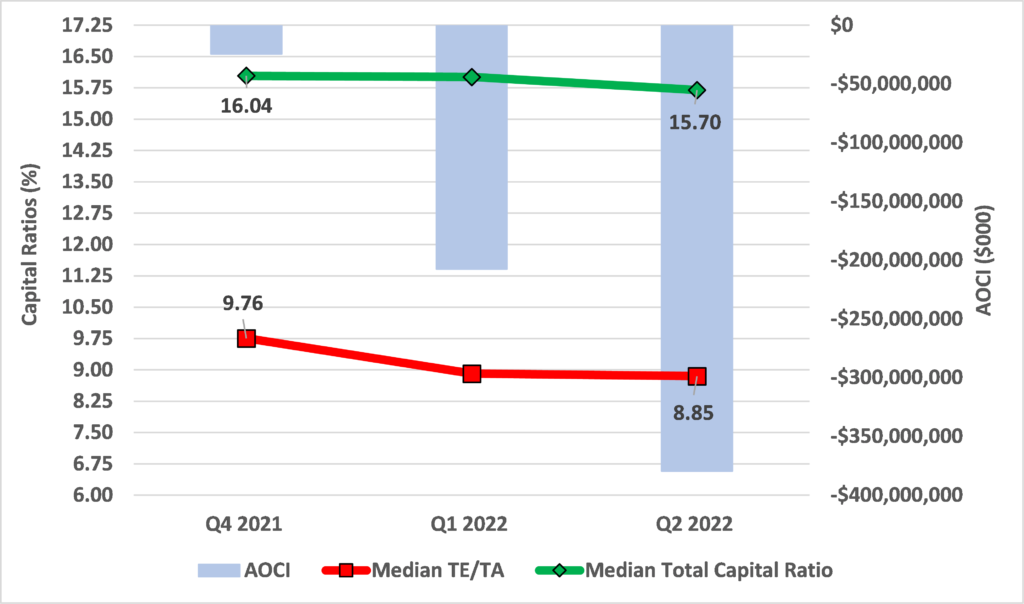

Let’s take a look at how the recent rate hikes have impacted bank’s capital ratios. Accumulated other comprehensive income (“AOCI”) during the first quarter of 2022 went to negative $207.7 billion from negative $24.6 billion in the fourth quarter of 2021 for all U.S. banks. AOCI during the second quarter of 2022 went to negative $379.6 billion. Currently the Atlanta Federal Reserve Bank is predicting a 95% chance of another 25 basis point rate hike by the September FOMC meeting. With the current target fed funds rate range at 225 basis points to 250 basis points, and consensus assuming another 25 to 100 basis points over the next several quarters, the impact on AOCI is likely to continue to trend in the wrong direction. And just like that, the fair value of banks AFS securities have dropped significantly in the first half of 2022. The following graphic shows the rate of change in interest rates and the cumulative AOCI adjustments for Q2 2022 for all U.S. banks*.

*Reported information as of 08/17/2022, includes 4,654 bank institutions. Depending on availability, data shown at consolidated or bank level.

The capital ratios in the above chart include tangible equity to tangible assets, a generally accepted accounting principle (“GAAP”) ratio, and total capital ratio, which is a regulatory capital ratio. Tangible equity to tangible assets ratio includes the AOCI adjustment, while the total capital ratio excludes it, as long as banks elect to opt-out of including AOCI in the regulatory capital calculation, therefore shielding themselves from the fluctuations, both up and down, from the change in AOCI. Since Q4 2021, the total capital ratio declined by 34 basis points compared to 91 basis points for the GAAP measure of tangible equity to tangible assets.

Rate Hike Forecasts and Analysts’ Estimates

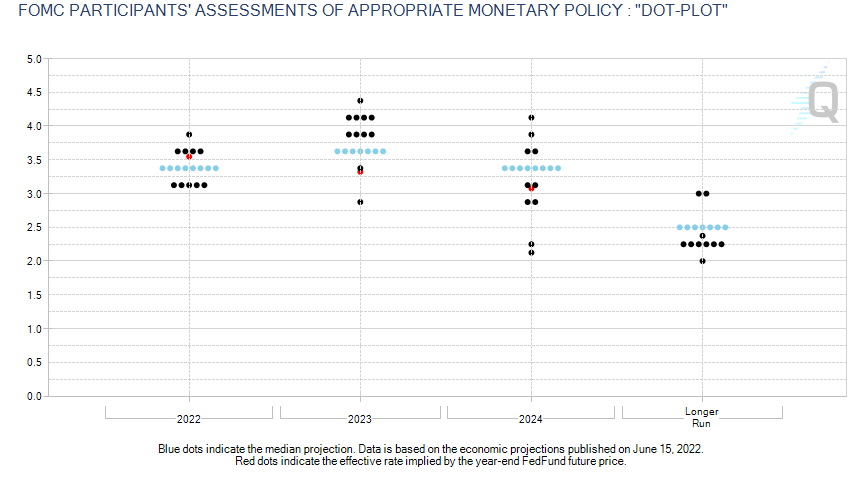

Inflationary pressure has been unrelenting and the FOMC has indicated that it will continue to increase the federal funds target rate in 2022. Both the FOMC and the futures market are indicating another rate increase by the end of 2022. Per the June 14-15, 2022 meeting Projection Materials, the FOMC’s median 2022 projected federal funds target rate is 3.4%, up from 1.9% at the March 15-16, 2022 projection. Futures markets (CME Group’s FedWatch Tool) gave a 72% probability of rates being between 1.8% and 2.3% on March 17, 2022, while on August 17, 2022 the futures market is indicating a 65% probability that rates are between 2.75% and 3.00%. There is a disconnect on where rates are anticipated, but they are directionally similar. The divergence occurs in 2023 and 2024, where the FOMC anticipates higher federal fund target rates relative to where the futures market has rates retreating. This may indicate markets are pricing in a recession. The following graphic sheds some light on the differential between where the futures market place expected rate hikes and the FOMC’s expectations.

CME Group’s Fed Watch Tool: FOMC “Dot-Plot” versus Implied Federal Fund Futures (8/17/2022)

While many factors drive changes in tangible book value per share, the change in AOCI due to the change in the fair value of securities resulting from rate hikes is the core driver in 2022. Of covered banks, analyst forecasts for 2022 tangible book value per share have fallen 9.0% since the March 2022 FOMC meeting. More recently, forecasts for tangible book value have been reduced by 3.3% between the June 15-16 meeting and August 17, 2022. Conversely, earnings per share (“EPS”) estimates have increased by 8.0% and approximately 4.0% over the same time frame, indicating that the decrease in tangible book value is not due to analysts adjusting down earnings estimates.

Items for Consideration

A rising rate environment is music to many bankers’ ears. However, it can be a double edge sword when calculating GAAP capital. With an influx of deposits as a result of government stimulus and a slowdown in loan growth due to the uncertainty surrounding the pandemic, banks loan to deposit ratios are at their lowest level in twenty years.

The shift from designating AFS securities to HTM securities can help shield the securities portfolio from further deterioration, therefore limiting the future impact of GAAP capital ratios. Thankfully, under U.S. Basel III, the regulatory capital calculation allows for banks to exclude AOCI through the AOCI opt-out election. Therefore, the big swings, both up and down, of the AOCI has no impact on regulatory capital ratios. This is an important takeaway when assessing the decision to transfer AFS securities to HTM securities:

- The premium or discount recorded as a yield adjustment is offset by the amortization of the yield adjustment, resulting in offsetting effects on the income statement.

- The unrealized gain or loss is determined at the date of transfer and remains a component of equity.

- The unrealized gain or loss is amortized over the remaining life.

Additional items to consider:

- Unrealized losses incurred prior to transfer remains a component of GAAP capital until security reaches maturity.

- Under the HTM classification, a security cannot be sold except in a limited number of instances. The resulting impact is a reduction in asset-based balance sheet liquidity to liability-based liquidity through collateral based borrowing.

- Once AFS securities are transferred to HTM securities, an institution may be not be able to reposition HTM securities to take advantage of changing market rates.

- Any HTM securities with credit exposures may fall under Current Expected Credit Losses calculations, while AFS securities are exempt.

What does this mean for bankers?

1) Though AOCI has deteriorated, corporate governance and the policies governing monitoring have not changed for many banks. Having the proper tools and policies in place to manage interest rate risk is critical.

2) While regulators are aware of the AOCI issues, in the near term banks should expect greater regulatory scrutiny on economic value of equity (“EVE”) and review of impact of rising rates on net interest income.

3) Security analysts are not terribly focused on AOCI but rather liquidity and impact of rising rates on deposit betas and liquidity.

4) Rising interest rates have historically been good for banks as interest earning assets reprice more quickly than deposits. Is this cycle going to be different if new loans are hard to come by and deposit betas are higher than expected? So far it is too early to tell, but many large banks are reporting more favorable deposit betas.

5) Many bankers are treating their AFS portfolio as if it was HTM, borrowing to fund loan growth instead of redeeming securities, so they don’t turn the hypothetical loss in their securities portfolio into an actual loss.

And just like that, bankers are faced with another strategic decision when it comes to their securities portfolio and its impact on GAAP capital ratios. Bank’s balance sheets have reached new levels of liquidity, largely due to the increase in deposits as a result of the Pandemic. Many institutions increased their investment portfolios, driving down loan to deposit ratios. As investment portfolios ballooned, and interest rates have increased, there has been significant change in the fair values of nearly every institutions’ investment portfolios. Knowing the characteristics of your securities portfolio and how that impacts both GAAP and regulatory capital moving forward will continue to be top of mind for many bankers. But at the end of the day, AOCI is nothing more than an accounting entry on the balance sheet, right?

Click here to view printer-friendly version.

This newsletter relates to our Strategic Management service, click here for more information.

To receive our newsletter and other TKG content, subscribe at the bottom of this page.