Build a Moat Around Your Balance Sheet

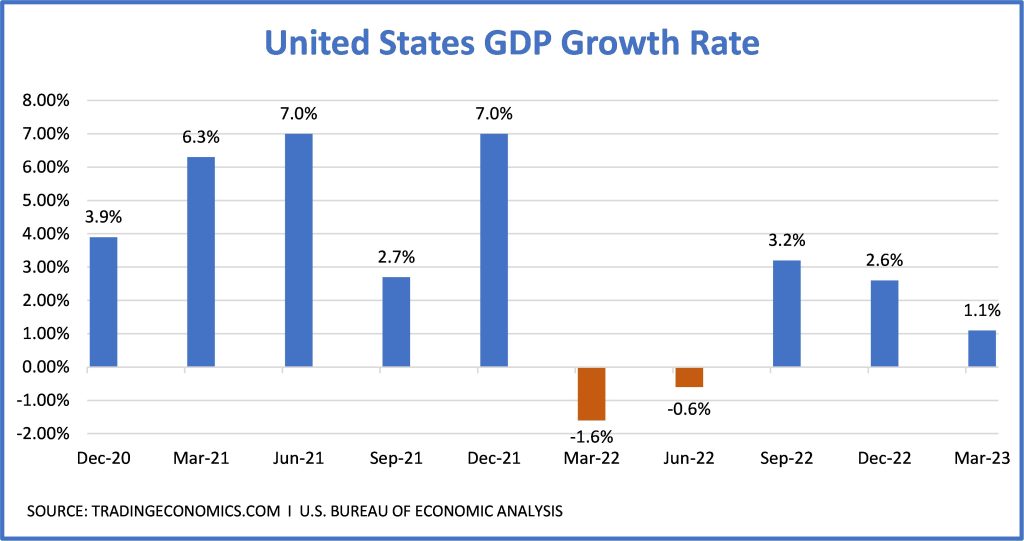

U.S. economic growth slowed in the first quarter to 1.1% after having notched 2.6% growth in the fourth quarter of 2022. Many economists expect the economy to slow even more as the year progresses, predicting a recession in the second half.

There are a number of factors that could lead to a recession in 2023, including the Federal Reserve continuing to raise interest rates in its effort to combat inflation. Inflation has cooled from 9.1% in June of last year but remains historically high at 5.0% as of March 2023. The exact pace of interest rate hikes is uncertain, but the Federal Reserve is expected to continue raising in 2023.

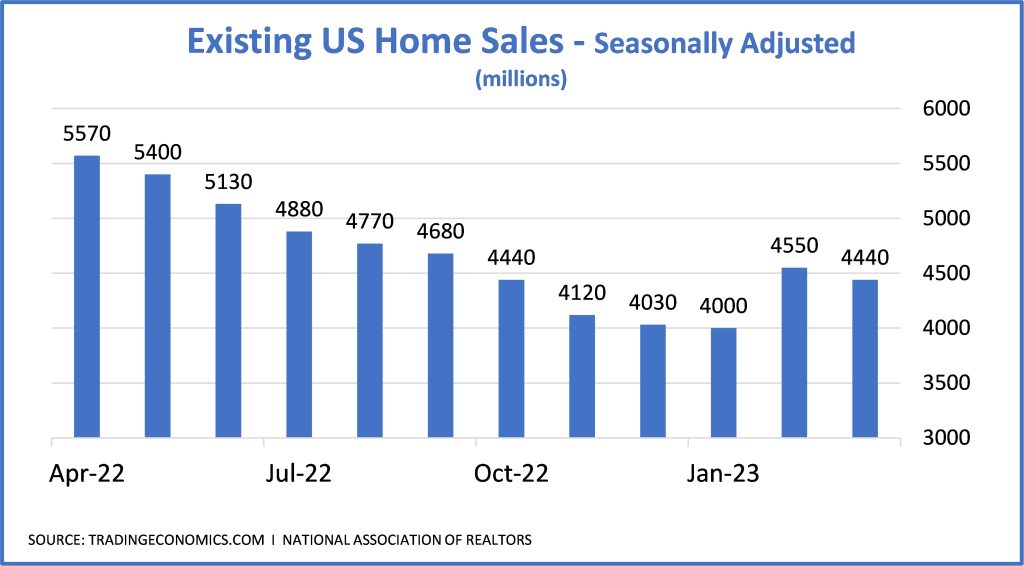

The housing market, booming for the past two years, has been cooling quickly. In February, existing home sales were down 20% from a year ago, partly as a result of rising interest rates. At 70% of US GDP, consumer spending is a significant driver of growth. The housing market’s decline will dent consumer confidence and may exacerbate a decline in spending.

Other factors weighing on growth are the failure of three midsized banks in March and April, which could lead to tighter lending conditions, the decline in gross private domestic investment (business investment) of 12.5% in the second quarter, and the continuing weight of the war in Ukraine on global supply chains and food and energy costs. While labor markets have added over 4.1 million jobs over the past 12 months, wage growth of 4.7% is not keeping pace with inflation. Recession in late 2023 or early 2024 is not certain but there are steps community banks can take to prepare for a further slowdown in the economy.

Past recessions have impacted community banks in different ways. The latest recession, caused by the Covid-19 pandemic, saw massive government intervention through the CARES Act. The $2.2 trillion economic stimulus package passed in March 2020 provided direct payments to individuals, loans to small businesses, and funding for state and local governments. Banks braced for significant increases in loan losses. However, because of the stimulus, consumers and businesses were able to maintain debt service payments. Continued low interest rates helped keep borrowing costs down and insulated banks from deposit runoff.

The great recession (December 2007 to June 2009) had a significant impact on the community banking industry in the US. This recession was led by the busting of the housing bubble. The recession led to a decline in lending, a decrease in deposits, and an increase in loan losses. As a result, many community banks were forced to merge with other banks, or to close their doors altogether. The federal government provided TARP to banks. The $700 billion program was used to purchase troubled assets from banks and other financial institutions, and to provide liquidity to the financial system.

It’s not clear how the latest slowdown in economic activity will impact community banks this time around. Banks have already seen deposit pricing pressure, as competition for deposits has heated up and the industry as a whole has lost more than $760 billion in deposits over the last 12 months. While loan loss rates remain historically low, the canary in the coal mine may be credit card and auto loan delinquencies, which are both increasing, according to the Quarterly Report on Household Debt and Credit published by the Federal Reserve Bank of New York.

For those among us who are concerned about a looming recession and its impact on our banks, here are some time-honored steps banks can take to be better prepared.

Strengthen liquidity position. A strong liquidity position will help banks weather a recession. Deposit outflows from banks, as noted above, demonstrate the need for increased liquidity. Yields on cash and short-term securities continue to outpace longer dated securities. The current yield curve, shown against that of the beginning of 2023 shows how shorter dated securities yields have increased. Positioning the securities portfolio with more cash and short-term securities will have a positive impact on liquidity ratios.

Banks can improve the management of liquidity risk by revisiting their liquidity and contingency funding policies, as well as stress-testing their liquidity positions. Asset ‘haircuts’ and deposit runoff modeling can point out weaknesses in a bank’s liquidity position. Monitoring maximum borrowing capacity and testing FHLB and Fed borrowing lines periodically can help ensure liquidity is available in times of need. With the Silicon Valley Bank and Signature Bank failures over one weekend and the fear of contagion being palpable, will these lines work as intended if there are hundreds of other banks waiting in line to tap their lines? You should find out.

Review lending practices. Prior to a recession is the time for banks to review lending policies and procedures. Tightening lending metrics, sharpening analysis, and reducing exceptions are all ways to improve underwriting. Banks should focus on borrowers with strong repayment capacity, higher liquidity, and lower leverage to reduce the occurrence of credit losses during an economic downturn.

Decrease leverage. To prepare for a recession, community banks can slow the growth of their balance sheets, thereby reducing leverage. Limiting the purchase of new securities in the investment portfolio, particularly those with higher risk weights, can decrease leverage and increase capital ratios. Additionally, tightening lending standards, increasing rates, and reducing approvals, as discussed above, can slow the addition of new loans to the portfolio. When new originations are less than payoffs and amortization in the portfolio, loans will decrease. Slowing asset growth below retention of earnings will reduce leverage and lead to a reduction in overall risk exposure.

Increase capital. Preparing for a recession may include increasing capital. The most common way for community banks to increase capital is to retain more earnings. Raising rates and fees and lowering overhead through efficiency improvements and branch consolidation will improve profitability. Reductions in special dividends or regular dividend growth will preserve capital. Raising capital through the sale of stock or through debt financing can also bolster capital heading into a recession.

Prepare for a decline in asset values. Bankers should review their loan loss calculations at this point in the economic cycle. Though lifetime historical loss rates continue to indicate that loan losses are expected to be low, banks should review current and forecast qualitative factors in the face of deteriorating economic conditions. Increasing reserves for loan losses can help the bank absorb losses that can reasonably be expected in the coming cycle. In addition to reserves, review the investment portfolio for securities that could be subject to credit risk and consider sales to reduce exposure.

The trend in GDP growth is certainly negative and opinions vary on the probability and severity of an economic downturn. Inflation, rising interest rates, and the slowdown in home sales all point to weaknesses for growth and while employment continues to rise, wage growth has not kept pace with inflation. Given the increasing probability of a recession, bankers would be wise to consider efforts to strengthen their balance sheets and improve profitability in anticipation of slower to negative growth ahead.

Click here to view printer-friendly version.

This newsletter relates to our Strategic Management service, click here for more information.

To receive our newsletter and other TKG content, subscribe at the bottom of this page.