Bank M&A – Show Me the Money

Deep down I’m a bit of a softie. And nostalgic. So, if my wife and I are watching TV on a Saturday night and I happen to come across “Jerry Maguire,” I tend to stop and watch awhile. Then she says, “not this movie again” and I move on. Not that Jerry Maguire is my favorite movie, but I appreciate the many intertwined story lines. There are also classic lines in this movie; “Show me the money!!!” is used constantly by Cuba Gooding’s character Rod Tidwell and another is, “Help Me Help You,” mouthed by Tom Cruise’s character Jerry Maguire. This TKG Newsletter is inspired by those two phrases and is my missive about whole bank mergers and acquisitions, kind of like Jerry Maguire’s late night, too much pizza inspired Mission Statement called “The Things We Think And Do Not Say”.

The year 2020 is going to be the year that will forever be associated with Covid-19, social justice and divisive politics. It will also be a watershed year for the U.S. commercial banking sector in that whole bank transactions are on pace for the lowest number of transactions since 2009. The banking industry’s estimated consolidation rate for 2020 is 2.9% versus 4.4% average over the last six years.

While aggregate banking industry earnings for the quarter ended June 30, 2020 are down 70% from the quarter ended June 30, 2019, the fact is that bank earnings had stalled out in early 2018 and if earnings starting in Q1 2018 are adjusted to reflect a higher tax rate (prior to the enactment of the Tax Cut and Jobs Act of 2017) aggregate bank earnings have been essentially flat since 2015. In real terms, aggregate earnings growth is negative since 2015. Yet bank transactions were getting done and acquisition valuations – while well below historical highs – had stabilized. It seemed like a scenario that would further accelerate banking industry consolidation.

Let’s take a look at what may be driving this slow-down in bank transactions. And we’ll also contemplate reasons why there should be more activity, not less. In our view there are three primary variables that have slowed bank transactions, the order of which can be debated. The first variable is that the banking industry focused on what needed to get done to serve customers and keep operating during the pandemic. The second variable is sellers for the most part have continued to focus on absolute price to be received and continue to ignore relative valuation. The third variable is “all things” regulatory, from perceived delays in application processing to perceived increased regulatory scrutiny of applications. These three variables should also be considered in the context that many serial acquirors have become larger and do not have interest in acquiring smaller banks or are looking elsewhere for transactions (such as fintech).

Looking Inward

The banking industry focused on what needed to get done to keep operating during the pandemic. That means everything from getting people to work remotely in order to continue to service customers, getting systems in sync to handle Paycheck Protection Program (“PPP”) loans and so on.

The industry’s financial performance will not be strong in 2020, though it won’t be as bad as during and immediately after the Great Recession. In spite of this, the banking industry should be proud of what has been accomplished in 2020 – culturally it has been an exceptionally good year. Especially within community banks. Never before have so many banks worked in such a collaborative manner and communicated so clearly with each other to get things done; ad hoc teams were pulled together to implement new processes and technologies to respond to and anticipate customer needs. It’s not just about PPP loans; it’s about loan deferrals and forbearances and providing service through channels other than the branch system. It’s about helping families, and the communities in which banks operate.

What does this have to do with bank transactions? Everything. There are only so many hours in the day. Resources are limited and decisions must be made on where to utilize those resources. People are not machines. We know of clients that had teams working around the clock to get things done for their customers. In this environment, due diligence is even more critical and due diligence takes time and resources. Not just credit-focused due diligence but operational due diligence. There really was no decision here, as banking focused on their customers first and foremost. Transactions took a back seat in the first six months of 2020 as priorities shifted.

Absolute vs. Relative Valuation

Potential sellers, historically and likely forever, by and large focus on absolute price to be received and ignore relative valuation. Sellers want to wait it out until they can get a higher price – the “grass is always greener on the other side of the fence” thinking. Reality is, we have seen many institutions over the years try this approach only to find out in real and relative terms the value they received after waiting pales in comparison to the original opportunity. The answer is fairly straightforward as to why the decline: a deterioration in the trading valuation metrics of the banking industry, driven by uncertainty and a divergence in multiples relative to other sectors, particularly technology. Many would be acquirors just don’t have the currency to effectuate stock transactions.

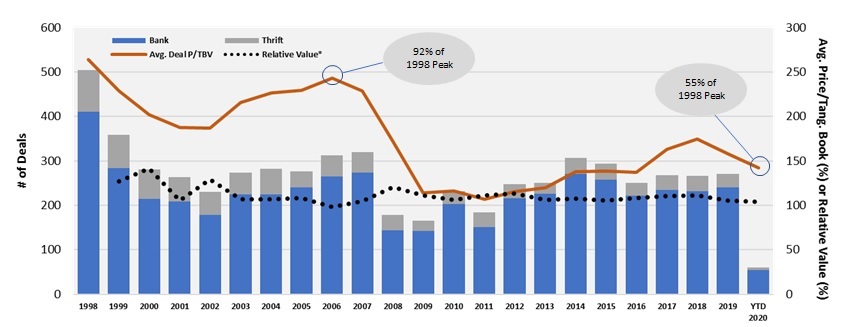

In addition to being a bit of a softie, I am also a thru and thru quant. So, let’s take a look at absolute versus relative acquisition valuations. Figure 1 is something we at TKG continuously monitor and have for twenty years (longer if you include my time prior to TKG). Follow the solid line … the banking industry’s highest acquisition valuation multiples occurred in very late 1997 and early 1998. As the market again frothed in 2006, valuations increased. I’ll go so far as saying that despite trying for nearly two decades, I have yet to come up with any plausible scenario where acquisition valuations will ever again hit the levels seen in 1998.

The dotted line is something that you may have never seen. It’s the relative acquisition valuation pricing. Here we are taking an acquirors price/tangible book value at deal announcement and dividing it by the price/tangible book value as offered in a transaction. The dotted line reflects the median of all deals involving stock as consideration. Traditional M&A analytics are focused on accretion (dilution) metrics, driven in large part by relative valuation. The dotted line … relative valuation … does not show the volatility of absolute valuation. So, if one potential acquiror is trading at two times book and the other potential acquirors are trading at a lesser multiple, are you better off taking a stock that is trading out of line relative to peers? Does it matter if you as the seller get two times book from an acquiror trading at two times book or if you get 125% of book if the seller is trading at 125% of book. Nope. It matters to sellers’ investors – including the investment community – that are myopically focused only on price.

The Regulatory Environment

Besides the iconic phrases in Jerry Maguire, who can forget the cute kid that breaks the awkward and uncomfortable silence between Jerry Maguire and Dorothy Boyd when the kid says, “the human head weighs eight pounds?” That Maguire/Boyd awkwardness in the industry is between regulators and bankers and is in the form of what bankers are perceiving in terms of regulatory expectations during all of this.

There also may be a number of potential buyers sitting on the sidelines to see if they can pick up acquisitions with some FDIC assistance; why buy now when a target could be placed in receivership (for the record, I don’t see this as a current driver of the slow pace of transactions as the health of the industry is generally strong, with only 52 problem institutions as of June 30, 2020 vs. 252 as of December 31, 2008, which peaked at 884 problem institutions nearly three years later).

All this being said, the regulatory guidance on what to do is not clear and bankers want to keep their banks’ names out of the headlines. Cut cash dividends? Repurchase shares or not? Are there enough resources to process a bank merger application? How long will it take for approval? Examination cycles are uncertain too. Lastly, there is public policy. So far, the banking industry does not have the negative publicity and public outcry like that of the Great Recession. In my mind, “all things regulatory” is a distant third reason and pales in comparison to the other two reasons offered in this article.

The M&A Environment Going Forward

This is not the Great Recession part II. In some respects, it was (and may still be) worse. But way different in that there was such an onslaught of coordinated fiscal and monetary policy that expectations are the economy recovers sooner rather than later (be it a “V”, “W”, “U” or “K” or some other letter shaped recovery). The industry’s capital position is much stronger too, with equity/assets at 12/31/2019 being 11.32% versus 10.34% as of 12/31/2007. Plus, many banks regardless of size, have tapped the subordinated debt market to get “cheap” debt capital to further shore up capital adequacy. The banking industry is generally in good shape at the moment.

Bank transactions are still getting done in this environment. Just not as quickly as in recent years. There have been some deals with strong strategic rationale getting done (Provident Financial Services, Inc. and SB One Bancorp, Inc. comes to mind). Mergers of equals will also continue to be attractive (largely because control premiums are muted as they are driven by relative valuation). And deals where cash is king. On September 25, 2020, Dollar Mutual Bancorp, the $9.6 billion Pittsburgh, PA based mutual announced its intention to acquire Standard AVB Financial for $33.00 per share in cash. The deal multiples were not staggering at 1.08X price/book and 1.33X price/tangible book, but the control premium for Standard AVB was nearly 76%.

So, what will it take for bank transactions to accelerate and will acquisition valuations tick higher? Given the Federal Reserve’s recent commentary that the fed funds rate target will be near 0% until 2023, this in and by itself does not portend well for industry trading or acquisition valuations.

Institutions sell for a myriad of reasons and those reasons frequently involve variables other than price (like succession planning). In my mind there is a backlog of potential sellers, resulting in a market where buying opportunities may come to market concurrently or quickly sequentially. I’m no expert on supply and demand, but if supply increases more quickly than demand, acquisition valuations will be muted. Activity will increase more quickly than acquisition valuations.

A clearer picture on what happens with credit quality in banking is needed once the deferrals and forbearances run their course; this should help stabilize and nudge trading valuations upward, which in turn will help drive acquisition valuations higher. M&A is going to have to be driven by community bank acquirors reaching sequentially down in terms of asset size to make acquisitions to generate efficiencies and drive sustainable returns on equity. And that will only happen on a greater scale when inward challenges are resolved and when trading valuations edge higher. Until then, there continues to be a challenge in being shown the money.

Click here to view printer-friendly version.

This newsletter relates to our Financial Advisory service, click here for more information.

To receive our newsletter and other TKG content, subscribe at the bottom of this page.