The Talent and Customer Portal in the New Year

The Tradition that was New Year’s Day College Football

New Year’s Day was (and still is) one of my favorite days – besides the pork and sauerkraut, New Year’s Day represented the culmination of the college football bowl season. It was the Rose Bowl pitting the Big Ten champ against the PAC 12 champ. The legendary Keith Jackson called the game and soundly belted out some “Whoa Nellies” after an exciting play. I’d gather with friends that hosted an all-day party – starting at 11:00am with the Cotton Bowl and finishing around midnight after the Orange Bowl. It was glorious!

Fast forward to January 1, 2022. My beloved New Year’s Day tradition has lost its luster. Sure … there are still games on New Year’s Day. But the real show is on New Year’s Eve in the form of two college football playoff (“CFP”) games and again on January 10th with the championship game. While entertaining, the introduction of the CFP system was the beginning of the end of the college football bowls as I knew them. Another accelerator to change in the bowl season was the onset of COVID (and with this an aborted 2020-2021 season), and players electing not to play so they can get ready for the NFL draft.

The NCAA Transfer Portal Opens

The real end of college football bowls came in 2018 – October 15th, 2018 to be exact. It was the day the National Collegiate Athletic Association (“NCAA”) opened the “Transfer Portal”. The Transfer Portal (literally a database of athletes in all sports) is a way for a college athlete to change schools without sitting out a season (which was an archaic rule in its own right). A player – in any sport – can now go where they are wanted. I remember on that day in 2018 saying to myself “it’s about time players have the option to leave without sitting out a season, but this is going to be a sea change for the way college football programs manage their teams”. Patience readers. I’m getting to banking.

During the 2020-2021 college football season cycle, which ran from August 2020 to July 2021, 2,626 college football players from Football Bowl Subdivision (“FBS”) schools entered the Transfer Portal to find a new college team. That number will easily exceed 3,000 in the 2021-2022 cycle. For context, there are 130 FBS teams, each permitted 85 scholarship players (with rosters generally around 100 total players). That’s 13,605 total college football players; if 3,000 enter the portal, that’s 22% of the total players looking to potentially leave their current team.

Finding, Retaining and Managing Talent

Starting in 2021, student athletes now also have the right to earn compensation from their “name, image and likeness” (“NIL”). Given that a coach can leave anytime (like Brian Kelly abruptly leaving Notre Dame to coach at LSU – even though Tom Bailey of Brentwood Bank secretly wanted Kelly at Pitt), and that coaches profit from their NIL, is it really a surprise that when given a chance, players too will try to find greener pastures? It’s a right for student athletes that is long overdue as the NCAA was one of the last nearly unchecked monopolies, running rampant over college sports and overseeing a revenue stream from college athletics that in its entirety would surely qualify as a fortune 500 company.

From a coach’s perspective, with the advent of the Transfer Portal and the NIL concepts, recruiting is never complete. It’s still about recruiting high school athletes, but also finding new talent via the Transfer Portal and retaining talent that is still on the roster and importantly integrating (and quickly) new personnel into their football program’s way of doing things (their culture). What does this have to do with banking?

A Look at the ICBA 2022 Community Bank CEO Outlook

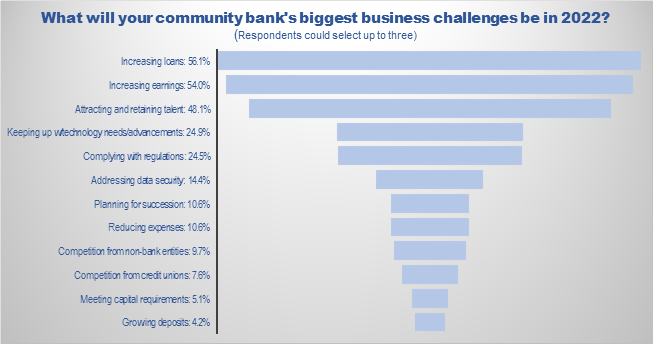

The ICBA recently released its “Community Bank CEO Outlook 2022: Your Priorities for the New Year”. This survey of community bank leaders is always interesting to me as many challenges resonate with me: increasing regulation (across the board, including an increased likelihood of bank mergers being more highly scrutinized) and technology and cybersecurity – topics that have been stalwarts for years on these types of surveys.

to me as many challenges resonate with me: increasing regulation (across the board, including an increased likelihood of bank mergers being more highly scrutinized) and technology and cybersecurity – topics that have been stalwarts for years on these types of surveys.

A bit surprising to me are some topics that did not make the list, such as: the high probability of rising interest rates. Maybe that is somewhat captured in the “increasing earnings” category. Also not making the list: the transition to CECL that is pending for these institutions, with a targeted adoption date of January 1, 2023. A quick look back at 2020 and 2021 shows that CECL will introduce earnings volatility. There was no mention of inflation or supply chain issues. No mention that the residential mortgage market gain-on-sale gravy train may be ending. No apparent concerns over credit quality, particularly from exposure to commercial real estate. No cryptocurrency or payments topics.

The Talent and Customer Transfer Portals in Banking Have Opened

Three issues that arise from the ICBA survey in my mind are united: increasing loans, keeping up with technology and succession planning. They all have one factor in common, the number three item on the list, Attracting and Retaining Talent. There is a certain fragility to an institution’s lifeblood when talent leaves – it impacts culture. And strategy. Given what we hear from clients, I’m surprised it’s not number one on the list. Especially seeing that people can work from anywhere. Or take part in the Great Resignation.

At the top of the 2022 survey list is the battle for loans. This in turn drives many banks to attract lending teams to their institution. Even modest books of business are being ascribed sizable value. Staffing shortages only exacerbate the inflationary salaries (and sign and stay bonuses) being commanded by lenders. Lenders with a book of business can write their own ticket. It’s fiercely competitive out there and nothing suggests a slowdown anytime soon.

But it goes beyond lending. If an employee has direct contact with a client, there is strong demand for that employee. How about finding and retaining IT talent and compliance/risk management talent? And once the talent is found, there is a need to offer more than a salary increase and a bonus – offer advancement opportunities. It’s about succession, diversity, and all things human capital. It’s going to be harder than ever to keep an organization’s team together, and with it, culture and strategy.

Another portal that is always open is the Customer Transfer Portal. In 2022, amid a drive by many institutions to make it easier to open accounts and the presence of Goldman Sachs’ Marcus (as one example), it’s never been easier for customers to open an account and move money. There are two exposures for a bank here (i) having a lot of no/low balance accounts on the core systems (and the expense associated with them) and (ii) losing customer relationships. Does your bank know if the customer you may be losing is worth keeping? Or the customer you want to win is worth winning? Maybe some customers need to be introduced to the Client Portal.

A topic that did not make the ICBA survey list is liquidity. And why should it, given the banking industry is flush with low cost and plentiful deposits? Given the ease of moving money amid the specter of rising interest rates, I think there will be a far greater challenge managing liquidity than expected for many institutions. If this happens, then the scramble for customer deposits will begin anew. Five hundred dollars for your new checking account, anyone… anyone?

Someday I hope that the NCAA and college football powers decide to go to a 16 team CFP. There is no reason it cannot be done and it would be financially rewarding for all involved. Particularly the student athletes.

As for the banking industry, 2022 is going to be a telling year. Many bank leaders feel core performance in 2022 will be a step up from the core performance in 2021 though the bottom line may not show it. And many bank leaders know there will be intense competition for human capital and customers. These bank leaders know that the Talent and Customer Portal in banking has opened.

Click here to view printer-friendly version.

This newsletter relates to our Strategic Management service, click here for more information.

To receive our newsletter and other TKG content, subscribe at the bottom of this page.