How Is That New Year Self-Improvement Program Going?

The start of each New Year is a good time for new beginnings. That’s when many of us start self-improvement programs. How is that self-improvement program going so far this year? We’re already a quarter through 2019, and have you stuck with your program?

While we may have gained a few pounds during the holidays, from time-to-time your financial institution could also become less disciplined and begin to add a few extra pounds, or excess capacity. How does this excess capacity sneak up on us? It may be the result of changes in customer behavior (lower branch transactions) or changes in economic and market conditions (reduction in residential lending). Those extra Christmas cookies may have resulted in the need to loosen your belt a notch or two. A financial institution’s “belt” may be the equivalent of an increasing efficiency ratio. If this is happening to your institution you must have the tools to identify exactly where in the organization the higher costs are coming from (i.e. Christmas cookies). If your institution has a performance measurement system, your job of identifying the source of those extra costs becomes a lot easier. A Performance Measurement system will provide you with the data to identify where the increase in the inefficiencies are located.

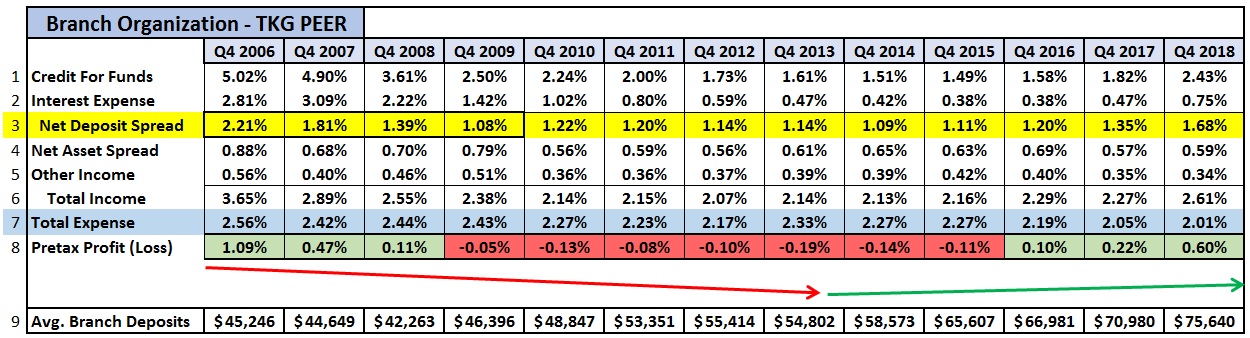

Since the “Great Recession”, we have seen the profitability of branches go through a few cycles (Chart below -TKG Performance Measurement PEER Data). At the end of 2006 when interest rates were higher, branches realized a “return on deposits” of 1.09% (see line 8 below). But as you will also see from the chart below, once interest rates began their steep decline (Fed Funds Rate of 5.25% in Q4 2006 was lowered to .25% in Q4 2008) branch profitability declined and was negative by the end of 2009.

Most of this decrease was the result of “net deposit spread” decreasing from 2.21% in Q4 2006 to 1.08% in Q4 2009, or a decrease of 113 basis points (see line 3 below). Net deposit spread is the difference between the “credit for funds” and interest expense. The credit for funds is based on the average duration of an institutions deposit products. The longer the duration of a deposit product, the further out we extend on the FHLB Fixed-Rate Advance curve to calculate the credit for funds. Since the credit for funds for non-term deposits is priced using duration pools that are developed by rolling averages, the credit for funds lags the actual change in rates. Many institutions tried to lower branch expenses to offset this decrease in the net deposit spread, but you will note on line 7 that the ratio of total branch expenses to deposits of 2.56% in Q4 2006 only decreased to 2.43% in Q4 2009, or 13 basis points.

Branches finally have become profitable again since Q4 2016 due to an increase in the deposit spread as rates started to rise. A more significant impact on the improved branch earnings was due to the reduction in expenses as a % of total deposits. From 2009 to 2018, there was a 12% decrease in the number of U.S. branches. This reduction combined with normalized deposit growth helped push the average branch size of our PEER institutions from $46.4 million in Q4 2009 to $75.6 in Q4 2018. The increase in branch size and improvements in processes within these institutions drove the ratio of branch related expenses to branch deposits down to 2.01% in Q4 2018. If, as some think, the Fed is finished with rate hikes, the profitability of deposits and therefore branches may not reach normal levels for some time to come. If true, branches may need to continue growing in size and reducing costs to improve efficiencies in order to meet profitability levels experienced in 2006.

For those institutions that do not have a performance measurement system, here are a few ratios you can use to check on the efficiencies of your branches:

Deposits per Branch FTE

A simple way to check the efficiency of each branch in your branch network is to calculate the level of deposits to each branch’s full-time equivalent employees (FTE). As we like to say, “how many deposits does each branches FTE have on their shoulders.” Our higher performing institutions have deposits to branch FTE of more than $10 million. If your ratio is under $10 million, your branch may not be reaching its full potential and may need to reduce costs or increase deposits. We still see many branches under $40 million in deposits with 5-to-7 FTE’s! High performing banks limit the number of employees at branches with low deposit levels to 4 FTE’s and we are starting to see some branches under $40 million with 3.5 or even 3.0 FTE’s. This may be the only way these lower deposit level branches can justify themselves and reach an acceptable level of profitability.

We also find that branches with higher levels of FTE’s may still be structured primarily as “transactional” branches and not as “consultative & sales” branches. As teller transactions continue to decline, transitioning to a consultative & sales branch, along with complementing digital channels, will be necessary to remain relevant. This transition requires branch personnel to possess the skills necessary to meet these new customer needs.

Direct Cost/Average Deposits

The data used for the Direct Cost/Average Deposit ratio should not be difficult to collect. If your bank has individual cost centers for each branch, they will likely include the direct cost (salary & benefits, rent, occupancy, FDIC insurance, etc.) and the total deposits attributed to each branch. We have found that the average branch has a Direct Cost/Average Deposit ratio of 1.00%. Basically, the cost to support $100 of deposits should be approximately $1.00. If you have a Performance Measurement system that allocates costs from support centers such as deposit operations and compliance to the branches, the total cost to support $100 of deposits in Q4 2018 was $2.01 (line #7 in chart above).

The Deposits per Branch FTE and the Direct Cost/Average Deposit ratios should provide you with some degree of knowledge of the efficiency of your branches. TKG likes to focus on data trends and suggests you calculate these ratios for each branch on a quarterly basis and use this data to track their performance over time. As the motivation to stick with a personal self-improvement program will result in you looking and feeling better, maintaining your financial institution’s independence may be the motivation your institution needs to track performance and improve operating efficiency.

TKG’s Performance Measurement outsourcing service is designed to provide institutions with profitability information for organizational units, lines-of-business, branches, and products. Our clients also use data from these profitability systems to feed customer level data into their MCIF and CRM systems. Over the years we have provided this service to hundreds of institutions, so they can foster an accountability culture and improve bottom line results. One of the most valuable components of our service is compiling PEER information which our clients use to measure against their own performance.

Are you interested in learning more about how your bank can utilize performance measurement information to make more informed decisions to enhance the profitability of your organization? If so, please contact me at gwagner@kafafianstg.wpenginepowered.com or call at 973.299.0300 ext. 114. In addition, for smaller institutions, we have recently introduced our “Performance Insight” service which is an affordable profitability measurement system designed for banks under $300 million in assets.

Click here to view printer-friendly version.

This newsletter relates to our Performance Measurement service, click here for more information.

To receive our newsletter and other TKG content, subscribe at the bottom of this page.