Navigating the Shifting Tides: Unraveling the Dynamics of Higher for Longer Rates and Profitability Trends in Community Banks

In the dynamic world of community banking, bank leaders find themselves at the helm of an industry experiencing pronounced shifts in profitability trends. As we await comprehensive Q4 peer data, Q3 data and anecdotal evidence points to intriguing developments that demand the attention of financial institution leadership.

Trend 1: The Entrenchment of the “Higher for Longer” Rate Environment

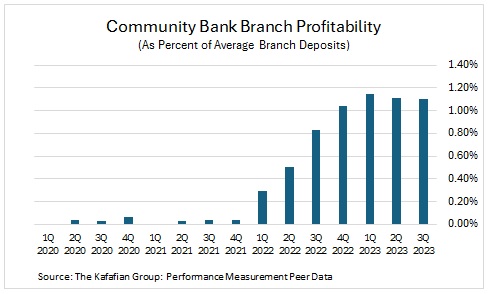

Over the past seven quarters, community banks enjoyed a positive trajectory of increasing deposit spreads resulting in a meaningful return to branch profitability. (Deposit spreads calculated as the difference between the FHLB borrowing rate of the corresponding product duration and the rate paid on that deposit, measured at the account level).

For most of 2022 and the first three quarters of 2023, deposits have been out-performing loans on a spread basis. Recent performance data suggests, however, that we have reached peak deposit and branch profit performance. This changing landscape created a paradigm shift in the contribution to Return on Assets (ROA) bankers had grown used to. For the past 15 years, loans have been far and away the primary bread winner for community financial institutions. But recently, loans and deposits are emerging as equal contributors to profitability, albeit within a compressed Net Interest Margin compared to five quarters ago.

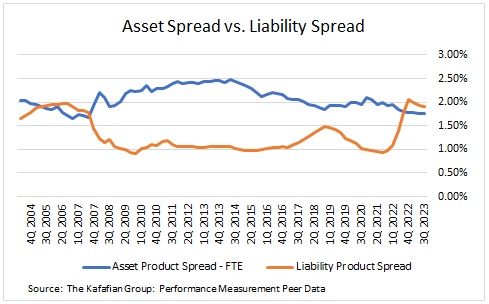

Now that the Fed Funds rates have leveled off (with likely upcoming rate cuts in 2024) a noteworthy reversal is underway as the spread between bank cost of funds and Fed Funds continues to narrow. The widely acknowledged “higher for longer” or the “new normal” rate environment is now exerting pressure on rapidly repricing CD and Money Market portfolios as community financial institutions fight to retain existing balances and for new deposit accounts.

Loan spreads are leveling off in the 1.77% range as bankers leverage the opportunity to price up the curve, while deposit spreads are experiencing a slight reversal, down to 1.90% from the peak of 2.05% in Q4 2022. Community bank leaders must carefully navigate this altered terrain to sustain and enhance overall profitability.

Trend 2: Deposit Mix Dynamics and the Dominance of CD Growth

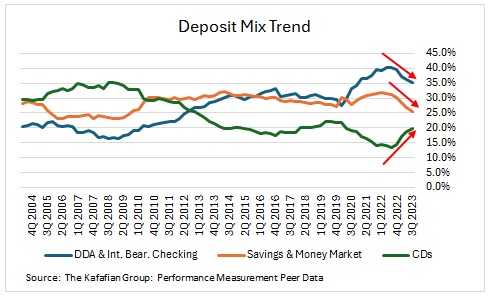

The second notable trend revolves around deposit dynamics, where the runoff is stabilizing, but the transformation in deposit mix is palpable.

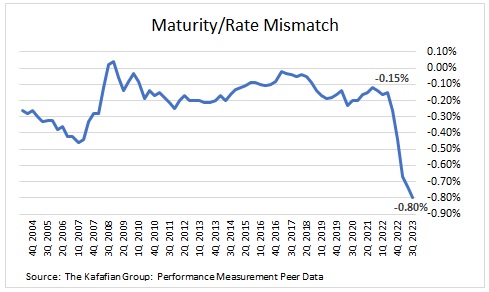

A key narrative unfolds as Certificate of Deposit (CD) growth takes precedence over Money Market accounts, significantly impacting both the cost of funds and the maturity rate mismatch. From an Asset Liability Committee (ALCO) perspective, the decision to reprice longer maturity money markets with 1-year CDs is amplifying the liability-sensitive nature of most institutions. In many cases, this mismatch stands out as the largest drag on profitability, urging community bank leaders to reassess their deposit strategies and align them with market realities coming in the next twelve months.

Implications for Community Financial Institution CFOs and CEOs

As these trends reshape the financial landscape, CFOs and CEOs must proactively strategize to address the implications. Here are key considerations for navigating these shifts:

Strategic Loan Pricing: With loan spreads expanding, community banks have an opportunity to strategically price loans along the curve, adding value to key client relationships, and including a renewed focus on appropriate risk adjusted pricing. This requires a nuanced approach to maximize the benefits of this trend, remaining competitive, adding value to highly profitable client relationships, and safeguarding against potential risks.

Deposit Mix Optimization: Given the dominance of CD growth, financial institution leaders must assess their deposit mix for optimal results. Balancing the need for core deposits with the cost implications of CD gathering becomes pivotal in maintaining a healthy and sustainable funding structure. A near-term focus on floating as much of the deposit portfolio as possible would be a prudent strategy, given the Federal Reserve’s projected rate reductions in 2024. And the difference between market rates and short-term CDs still delivers spread to those institutions that are not desperately trying to maintain balances because of liquidity concerns.

ALCO Reevaluation: The maturity rate mismatch highlighted by the shift in deposit dynamics necessitates a comprehensive review of ALCO strategies and deposit duration model assumptions. Adjusting to the liability-sensitive nature of the institution and mitigating the impact on profitability should be a priority for CFOs and CEOs. We likely missed the mark on money market durations and repricing during the Fed tightening cycle. Can we manage this in the future with data that tells us whether a depositor is price sensitive or is using the account as a store of value and is not demanding top rate?

Technology Integration for Process Improvement: As the industry undergoes transformation, and the need to control costs amid continued margin compression remains critical, leveraging technology becomes instrumental. CFOs and CEOs should encourage the exploration of innovative solutions to enhance operational efficiency, streamline processes, and adapt to the evolving banking landscape.

Conclusion: Navigating Uncertainty with Strategic Agility

To sum it up, community banks are facing changes in profitability contribution that bring both challenges and opportunities in 2024. How well leadership teams navigate these shifts will impact the success of their institutions. Adjusting deposit gathering, loan pricing, and technology deployment strategies proactively will be crucial for steering your institution toward sustainable profitability.

Click here to view printer-friendly version.

This TKG Perspective relates to our Performance Measurement service, click here for more information.

To receive our TKG Perspective and other TKG content, subscribe at the bottom of this page.